Topic Business

Date 15 Jul 2021

Galliford Try today provides an update on trading for the year ended 30 June 2021. The Group expects to announce its results for the full year on 16 September 2021.

Highlights

- Strong performance resulting in improved profitability and high-quality order book.

- Good progress against our margin improvement target, with full year profit before tax expected to be towards the upper end of the analysts’ current range1.

- Well-capitalised, with circa £215m of cash at 30 June 2021 (2020: £197.2m) and average month-end cash during the financial year of circa £164m.

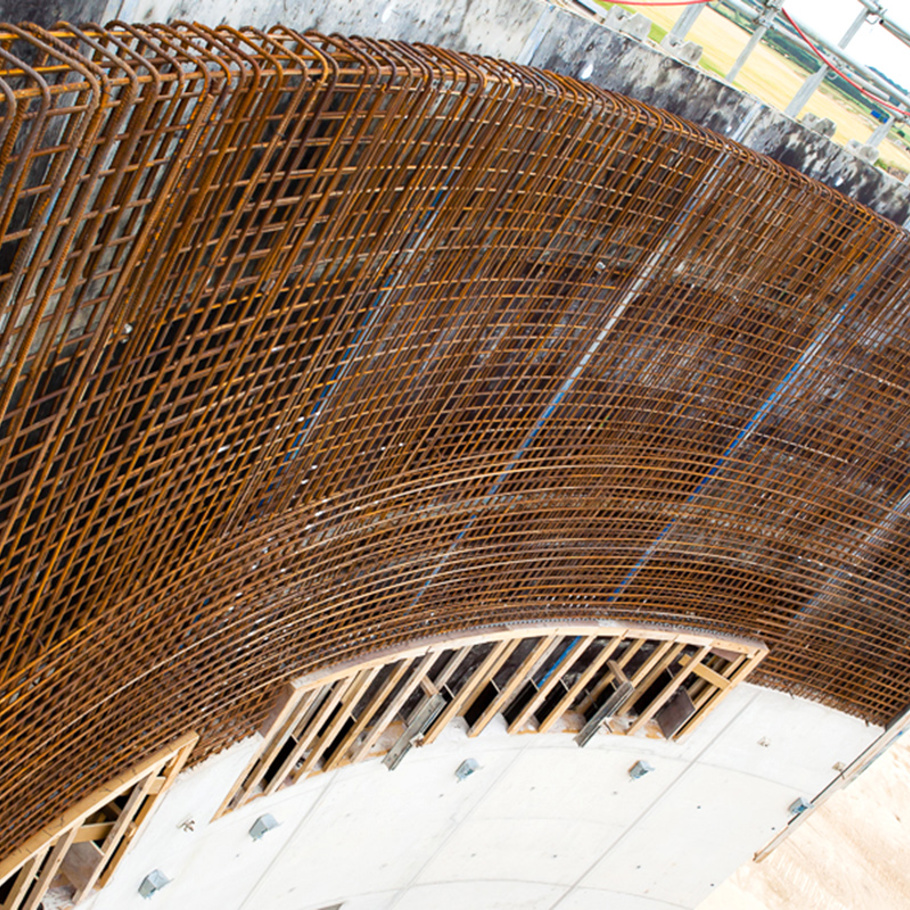

- All our construction sites are fully operational since the start of the financial year and progressing in line with our medium-term margin targets.

- Positive outlook, with a high-quality order book, in our chosen sectors, of £3.3bn (2020: £3.2bn). 90% of revenue for the new financial year secured (2020: 90%) and strong pipeline of future orders.

- Published commitment to achieve net zero2 across the Group’s own operations by 2030 and across all activities by 2045, validated by Science Based Targets.

Current Trading

In March 2021 we announced a return to profitability and resumption of dividends and are pleased to confirm that we have made further good operational progress. We expect to report full year profit before tax towards the upper end of the analysts’ current range.1

We continue to prioritise the health, safety and wellbeing of everyone on our sites and in our offices. All the Group’s construction sites are operating in accordance with strict Covid safety procedures with productivity at normal levels.

Our disciplined approach to bidding and active engagement with our supply chain have proved particularly important during the current period of materials shortages and inflation. We have successfully managed and mitigated these challenges without any material impact on trading. Our continuing investment in modern construction practices and digitalisation enables us to deliver quality to our customers and further improve our operational performance.

Balance Sheet

The Group’s strong balance sheet continues to be a differentiator for our clients and supports our ability to win high quality contracts and framework positions. Our financial strength also provides confidence to our supply chain, and we have further improved our prompt payment performance during the financial year. The average month-end cash for the financial year to 30 June 2021 was circa £164m and, in addition, the Group has a portfolio of PPP assets, no pensions liabilities and no debt or associated covenants.

Order Book

Throughout the financial year we have been successful in winning key projects and positions on strategic frameworks. We are encouraged by the pipeline of new opportunities across our chosen sectors, which align to our disciplined approach to risk management and contract selection.

Our focus on the public and regulated sectors makes us well placed to benefit from increasing Government investment in economic and social infrastructure, and our pipeline of work with high quality private sector clients continues to be robust. Major contract wins during the period, included in our £3.3bn order book, include:

- in Environment, for Scottish Water, the £350m SR21 Non-Infrastructure framework and the £350m Delivery Vehicle 2 programme;

- in Highways, our involvement in the £400m NEPO Civil Works framework and for Leicestershire County Council the £48m Grantham Southern Relief Road; and

- in Building the £41m Wallyford School for East Lothian Council and Hub South East.

Bill Hocking, Chief Executive, commented:

“We are pleased with the good progress we have made. Our people, working off firm foundations of risk management and contract discipline, have delivered strong financial results. We are meeting our objectives of operating sustainably and delivering controlled growth, cash generation and improved margins. The Group has an excellent order book and is strongly positioned to contribute to the UK’s economic recovery.

We were pleased to publish our net zero carbon targets recently, which build on our successful track record of reducing carbon emissions over the last decade. Operating sustainably is fully integrated into our strategy, and we will provide further details of our sustainability commitments with our annual results in September.

I am grateful for the dedication and resilience of all our people, which has contributed to the Group’s strong performance. We start the new financial year in an excellent position. The quality of our people, our balance sheet and our order book mean that I look forward to the new financial year with confidence.”